Gambling and the Wall street cheat sheet

Gambling and the wall street cheat sheet?

Gambling is an activity that has been around for centuries, and it is enjoyed by millions of people worldwide. However, it is also an activity that can be addictive and lead to negative consequences. In this blog post, we will explore the psychology of gambling and the highs and lows that gamblers face during a session. We will also draw similarities between the highs and lows encountered in gambling and the WallStreet Cheat Sheet that stock traders face in bull and bear markets.

The Psychology of Gambling

Gambling is an activity that involves risking something of value in the hope of winning something of greater value. It is a form of entertainment that can be enjoyed by people of all ages, genders, and backgrounds. However, it is also an activity that can be addictive and lead to negative consequences such as financial problems, relationship issues, and mental health problems.

The psychology of gambling is complex and multifaceted. There are many factors that contribute to why people gamble, including social, cultural, economic, and psychological factors. Some people gamble for fun or entertainment, while others gamble to escape from their problems or to cope with stress or anxiety.

One of the key psychological factors that contribute to gambling addiction is the concept of “intermittent reinforcement.” This refers to the idea that rewards are given out randomly and unpredictably, which makes them more desirable. In gambling, this means that people are more likely to continue gambling if they receive rewards intermittently rather than consistently.

The Highs and Lows of Gambling

During a session of gambling, gamblers experience a range of emotions from highs to lows. The highs are associated with winning, while the lows are associated with losing. The following are some examples of the highs and lows that gamblers experience during a session:

- Highs

- Excitement: The thrill of winning can be exhilarating.

- Euphoria: Winning can produce feelings of euphoria or extreme happiness.

- Relief: Winning can provide relief from stress or anxiety.

- Confidence: Winning can boost confidence levels.

- Lows

- Disappointment: Losing can be disappointing.

- Frustration: Losing can lead to feelings of frustration or anger.

- Desperation: Losing can lead to desperation or hopelessness.

- Regret: Losing can lead to feelings of regret or guilt.

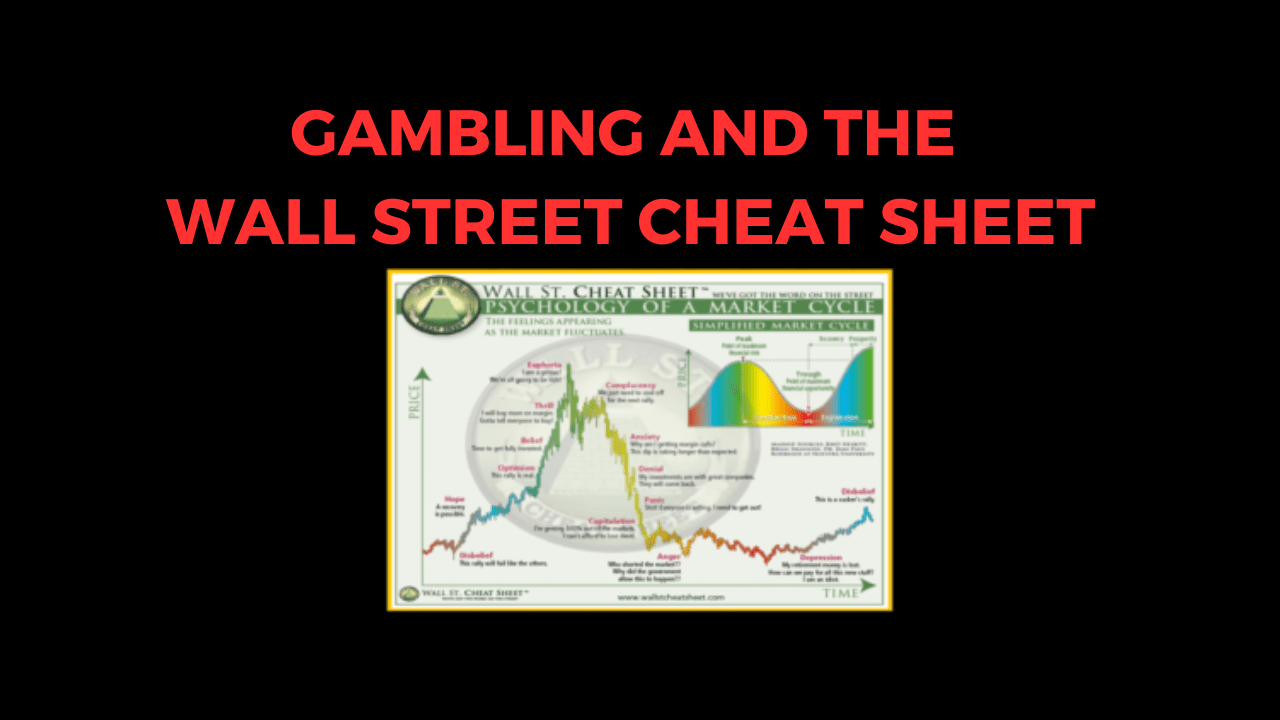

Similarities between Gambling and Wall Street Cheat Sheet

The highs and lows encountered in gambling are similar to those experienced by stock traders in bull and bear markets. The following are some similarities between the two:

- Intermittent Reinforcement: As mentioned earlier, intermittent reinforcement is a key psychological factor in gambling addiction. Similarly, stock traders experience intermittent reinforcement when they make successful trades.

- Emotions: Both gambling and stock trading involve a range of emotions from highs to lows. In both cases, winning produces positive emotions such as excitement, euphoria, relief, and confidence. Losing produces negative emotions such as disappointment, frustration, desperation, and regret.

- Risk: Both gambling and stock trading involve risk-taking behavior. In both cases, people are risking something of value in the hope of gaining something of greater value.

- Addiction: Both gambling and stock trading can be addictive. In both cases, people can become addicted to the highs associated with winning.

In conclusion, gambling is an activity that has been around for centuries and is enjoyed by millions of people worldwide. However, it is also an activity that can be addictive and lead to negative consequences. During a session of gambling, gamblers experience a range of emotions from highs to lows. The highs are associated with winning, while the lows are associated with losing. The psychology behind gambling is complex and multifaceted. There are many factors that contribute to why people gamble, including social, cultural, economic, and psychological factors.

The similarities between the highs and lows encountered in gambling and the Wall Street Cheat Sheet that stock traders face in bull and bear markets are striking. Both involve intermittent reinforcement, emotions ranging from highs to lows, risk-taking behavior, and addiction potential.

I hope this blog post provides you with valuable insights into the psychology behind gambling.

Relevant news

Roaring 21 Casino Review

See the best cryptocurrency casinos Roaring 21 Casino Overview: Roaring 21 comes from probably THE…

Detroit casinos set all-time gaming revenue record in March

Detroit casinos set all-time gaming revenue record in March BY Peter Amsel ON April 13,…

Slot Machine Tips – The Basics

SLOT MACHINE BASICS You are reading this guide because you want to learn how slot…

SLOTS BONUS EVENTS

Bonus features are where much of the creative, interactive fun of slot machines is focused.…

888 Tiger Casino Review

The best just got better, 888Tiger Casino used to have a great reputation but they…

Roaring 21 Casino Review

See the best cryptocurrency casinos Roaring 21 Casino Overview: Roaring 21 comes from probably THE…

Detroit casinos set all-time gaming revenue record in March

Detroit casinos set all-time gaming revenue record in March BY Peter Amsel ON April 13,…

Slot Machine Tips – The Basics

SLOT MACHINE BASICS You are reading this guide because you want to learn how slot…

SLOTS BONUS EVENTS

Bonus features are where much of the creative, interactive fun of slot machines is focused.…

888 Tiger Casino Review

The best just got better, 888Tiger Casino used to have a great reputation but they…