How You Can Earn More with Crypto Leverage Trading

Leverage trading, also often referred to as margin trading, denotes a mechanism that allows you to buy crypto by borrowing some of the purchase prices. The borrowed funds, which are usually provided by your broker, are called the margin loan, hence the term ‘to buy on margin’. Your equity is that portion of the purchase price that you must supply to enter a trade, which is called the required margin.

Traditionally, trading was much simpler, and the semantics involved were easier to grasp as there were no plethora of features to consider. But then, cryptocurrencies came along. The volatility nature of the crypto markets deems them more profitable than the initial stock and forex trading. Unfortunately, quoting Spiderman, with so much power (more profits), comes great responsibility (complexities).

In that note, the parlance in crypto trading comprises a great deal of phrases that could be overwhelming even to the expert traders. Today, the team at slots rtp has chosen to tackle one particular crypto trading term – Leverage trading.

Buying cryptocurrency such as BTC on margin can significantly increase the potential returns earned for a given amount of equity in a position because the margin allows you to buy more than you could without it. Therefore, while your initial equity is not changed, the magnitude of potential profit is multiplied by the amount leveraged.

More or so, financial products, such as options and futures contracts, are another way to add leverage.

Through the use of options and futures, investors can capitalize on price movements if they get the timing right. Much larger investment returns can be earned by correctly predicting price movements on a futures or options contract compared to merely holding the underlying digital asset.

How Crypto Leverage Trading Works

Basically, in leverage trading, the trader gives an exchange a little bit of crypto in return for a lot more capital to trade with and risks it all for the chance to make an even larger profit.

Different crypto exchanges offer differing amounts of leverage. Some platforms offer investors up to 200X leverage, enabling them to open a position 200 times the value of their initial crypto deposit. However, most exchanges often limit leverage to 20X, 50X, or 100X.

Leverage trading sounds great at first glance: the ability to multiply profits by 100X would capture the attention of any crypto investor.

However, despite all the pleasantries of margin trading, there is also a downside to them. Using the margin trading method can amplify your position and expose you to higher investment risk.

On the bright side, the increase in risk when margin trading, crypto is not proportionate to leverage. Trading with 100X leverage, for example, won’t multiply your losses by 100X — it’s most often not possible to lose more than you originally committed to the trade.

Advantages of Leverage trading

Leverage has become a prevalent technique among crypto investors internationally due to several reasons.

Firstly, the use of leverage is wholly automated, with each distinct financial instrument having a predefined size of leverage. When an investor commits to a particular trade, leverage is applied automatically.

Secondly, traders do not bear any risk of losing the borrowed margin. Brokers use a stop out mechanism, making the use of borrowed funds completely safe for investors. In essence, a trader only risks losing their own equity.

That said, the greatest advantage of using leverage is that you magnify your gains by using the same amount of equity.

Even more impressively, using leveraged products to speculate on market movements enables you to benefit from markets that are falling, as well as those that are rising.

Traders also get the chance to free up capital that can be committed to other investments.

Crypto Margin Trading Strategies

There are many vital strategies that you should look into before margin trading cryptos:

• Progressively increase trade size: If you’re new to margin trading, it’s best to develop a firm understanding of the practice by starting with smaller position sizes and lower leverage.

• Try your hand at demo trading: Paper trading, also known as demo trading, allows new traders to put their strategies into action without risking capital.

Note: You should know that demo trading platforms don’t make real money, but they do reflect real market prices.

• Understand order types: Margin traders often use combinations of order types such as ‘stop-loss’ and ‘take profit’ to lower risk and open complex positions. Such order types can be useful in setting up specific profit or loss goals and automatically closing trading positions.

• Pay close attention to fees and interest: When you open a leveraged position, you will usually have to pay interest on the margin borrowed. Leverage trading typically incurs ongoing fees that can swiftly cut into your returns.

Leading Crypto Platforms Offering Leverage Trading

Very few crypto exchanges offer leverage trading. That’s because the feature is more rewarding to traders that it is to the platform. But still, some exchanges have considered the needs of their users more than the essence of generating profits. Thus, for that matter, they have included this feature, which could be a liability to the company’s equity.

Below are some of our top 4 picks crypto platforms that offer leverage trading in the crypto space 2020.

Prime XBT

This exchange offers investors up to 100x leverage on any available digital asset on the platform. This includes top cryptos such as BTC, ETH, XRP, and Litecoin (LTC). It also consists of both long and short positions.

More importantly, Prime XBT offers investors with accumulated liquidity in order to deliver the optimum price from twelve diverse prominent liquidity providers.

It accepts BTC, USD, EUR, as well as a wide variety of cryptocurrencies that Changelly supports with zero deposit fees. Additional features include advanced order types (ex. stop-loss), whose lowest fee is only 0.05%, and no KYC requirements.

BitMEX

This exchange prides itself on offering up to 100x leverage on ETH 50x, LTC 33.3x, ADA 20x, and XRP 20x, which can instantly be traded against BTC.

Fortunately, BitMEX has zero deposit fee and considerably low margin fees 0.25% on digital assets and absolutely no KYC requirements.

OKEx

This platform offers up to 5x leverage on BTC, ETH, LTC, and other leading cryptos. Additionally, OKEx offers investors up to 3x on DASH, Bitcoin SV (BSV), and NEO. OKEx also consists of both long and short positions and accepts deposits in a variety of tokens, including BTC, ETH, and Tether (USDT). The deposit fees vary.

The platform is beefed up with advanced trading order types, including stop-loss and extremely high liquidity. The fees range between 0.015% and 0.075%. There is a KYC requirement for withdrawing funds.

Bitfinex

Bitfinex offers up to 3.3x leverage on a hand-picked selection of digital assets. It also consists of both long and short positions and accepts BTC, major altcoins, and fiat. The fees of deposit vary.

The platform offers advanced trading order types, including stop-loss, and has substantially high liquidity. The fees include 0.1 percent maker and 0.2 percent taker.

Unfortunately, Bitfinex has a long KYC procedure, which can take up to 8 weeks for full account verification.

In Summary

Leveraged trading is used by almost all types of traders as well as institutional investors. It is applied universally by traders in different asset classes, including cryptos, forex, stocks, and futures.

Leveraged crypto trading is specifically highly popular among active individual traders. This includes both beginners and professional traders, who are trading digital assets for their own accounts.

When you decide to utilize leveraged trading on cryptocurrency markets, you must first open a margin account with a reputable exchange that offers suitable leverages.

Also, it’s essential to look at the fiat support options offered by a particular crypto exchange when margin trading.

Tip: You should go for exchanges that offer both crypto margin trading and fiat deposits. This option allows you to be able to fund or withdraw from an account via wire transfer or credit card payments.

Parting shot: We would advise you not to invest more than you can afford to lose. Despite the possibility of earning boosted profits, you still stand a chance to lose your initial funds if your analysis goes wrong.

**Happy Trading**

Relevant news

Tron Casinos – TRX Casinos

TRX and TRC based gambling sites like Dice, TronBet and all the dozens of others…

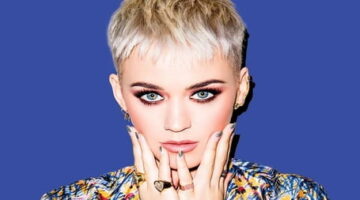

Celebrities Who Have Endorsed Crypto Projects and Their Impact to Those Projects

Initially, only a few financial gurus and the like showed interest in cryptocurrencies. However, over…

DeFi Project, Polychain-Backed Paradigm Labs, Shuts Down For Lack Of Product-Market Fit

Disappointing moment for the DeFi sector as the ambitious DeFi liquidity project, Paradigm labs shut…

Understanding the Tezos Ecosystem in Depth

Whenever the topic of blockchain and cryptocurrencies comes up, the word mining is bound to…

Mega Moolah 5-Reel Drive

Mega Moolah: 5 Reel Drive Most gamers know the Mega Moolah series of slot machine…

How Cryptocurrency Donations Can Benefit Non-Profit Organizations

Charity donations are not the first thing that comes to mind when you hear cryptocurrencies.…